Asset Allocation

The University has developed asset allocation guidelines based on its total return objectives, income requirements, and capital market expectations. These guidelines are long-term oriented and are consistent with the endowment’s risk posture and investment objectives. We have seen dramatic changes to our asset allocation over the last twenty-six years with the allocation to domestic stocks and bonds falling from more than 80% of endowment assets to less than 30% today. These funds have been redeployed into the international equity markets and alternative assets such as hedge funds and private equity funds which should not only provide higher returns in a greater variety of investment environments but also help to control overall risk.

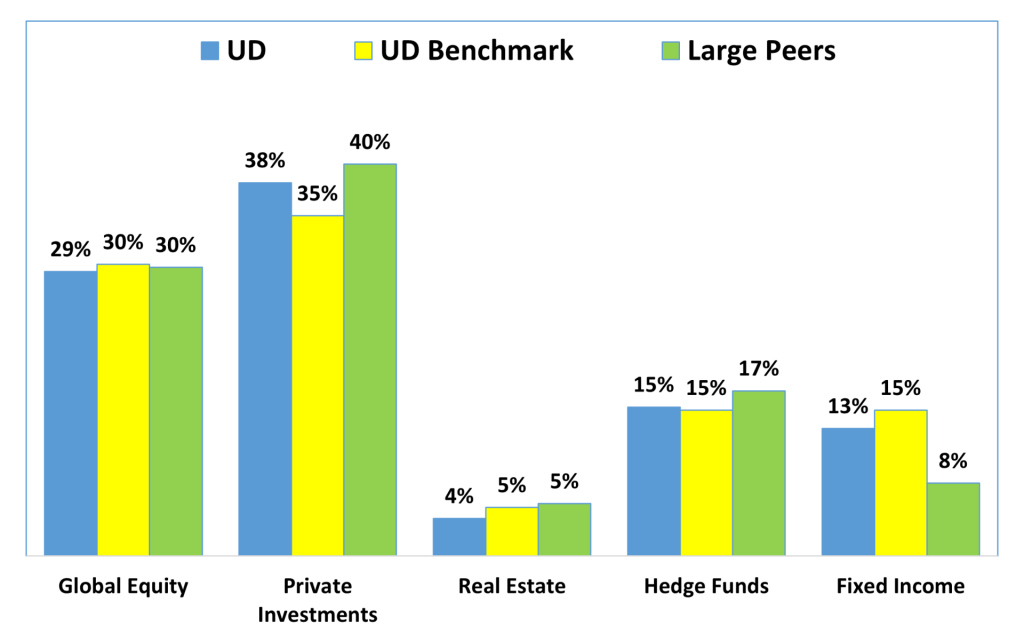

Endowment Asset Allocations vs. Target Allocations as of 6/30/23